Washington, D.C., ACA Filing Requirement

This article explains the new Washington, D.C., ACA filing requirement and how you can download an import file from Namely Payroll that you can then submit to the DC tax agency.

OVERVIEW

The District of Columbia now requires that all DC residents have minimal essential health care coverage. Employers who have employees who paid taxes in DC or who had a mailing address in DC may be required to file with the DC Office of Tax and Revenue to confirm that they are in compliance. Please reach out to your broker to confirm whether you are required to file.

LOCATING THE DC ACA UPLOAD FILE IN NAMELY

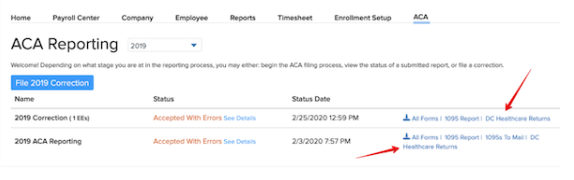

To help you with this filing, you will now find a downloadable file in Namely Payroll that you can upload directly to DC’s portal. You can access this file by navigating to the ACA tab in your Namely Payroll site; at the end of each row, you will see DC Healthcare Returns:

Note: you will find links to DC upload files for both your initial filing and for any corrected filings. In the event that one of your corrected filings does not contain any applicable DC employees, this file will display an error; DC Healthcare Returns files will only display data when they contain employees applicable for DC filing.

HOW TO SUBMIT TO DC

Once you have downloaded the file(s), please follow the filing instructions from the DC Office of Tax and Revenue, which begin on page 6 of this document.

Note: if you are prompted to pick an ACA file type for the upload file as you proceed through the DC portal, please indicate that the file is a 1095-C.